The Strategic Imperative for Specialty Care Access in Modern Healthcare

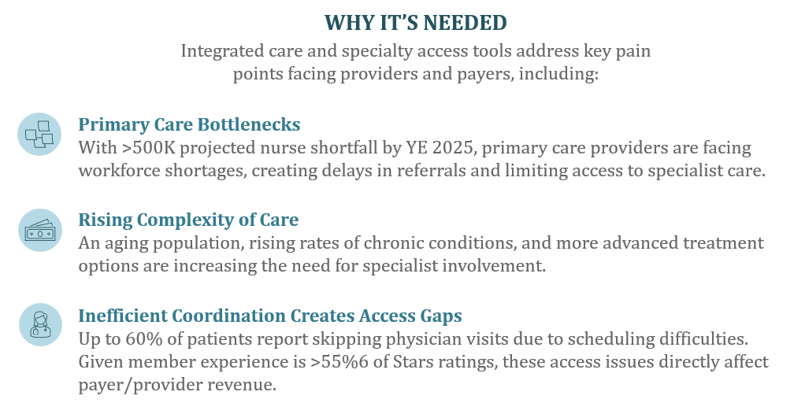

Specialty care access has emerged as a critical driver of transformation in U.S. healthcare, reshaping how providers and payers address the country’s most urgent challenges. Converging trends – shrinking clinical workforces, rising patient complexity, and the shift toward value-based payments – are prompting health systems, payers, and employers to rapidly adopt innovative specialty care platforms. These solutions integrate digital triage, streamlined referrals, patient navigation, and hybrid care delivery models to enhance patient outcomes and financial performance.

Four Major Investment Imperatives

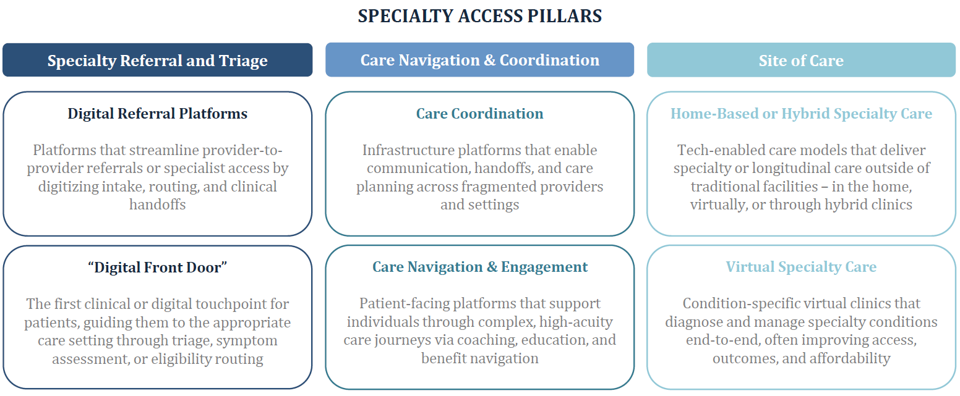

- Streamlining Referral and Triage

-

- The average specialist wait time has climbed to 31 days, and over 60% of patients skip care due to scheduling difficulties, underscoring the pain points digital referral and triage platforms must address.

- Leading solutions leverage AI for rapid intake, optimal routing, and provider matching, cutting leakage (worth up to $971,000 per physician) and driving meaningful Star Ratings impact by proactively addressing downstream care gaps.

- Longitudinal Navigation and Engagement

-

- 60% of Americans now have at least one chronic condition, propelling demand for platforms that offer long-term, condition-specific navigation, coaching, and connected care.

- Integrations with EHRs, benefit management, and real-time care plan tracking empower payers and providers to retain members, reduce unnecessary escalations, and improve chronic care outcomes.

- Delivering Hybrid and Home-Based Care

-

- Market adoption of hybrid models is accelerating, with home infusion, virtual monitoring, and “hospital-at-home” programs seeing sustained high-single-digit growth.

- Health systems are shifting toward models where 50% of specialty revenue is tied to value-based contracts – especially in orthopedics, oncology, and women’s health – furthering demand for technology that bridges settings and provides site-appropriate care.

- Structural Payer-Provider Partnerships

-

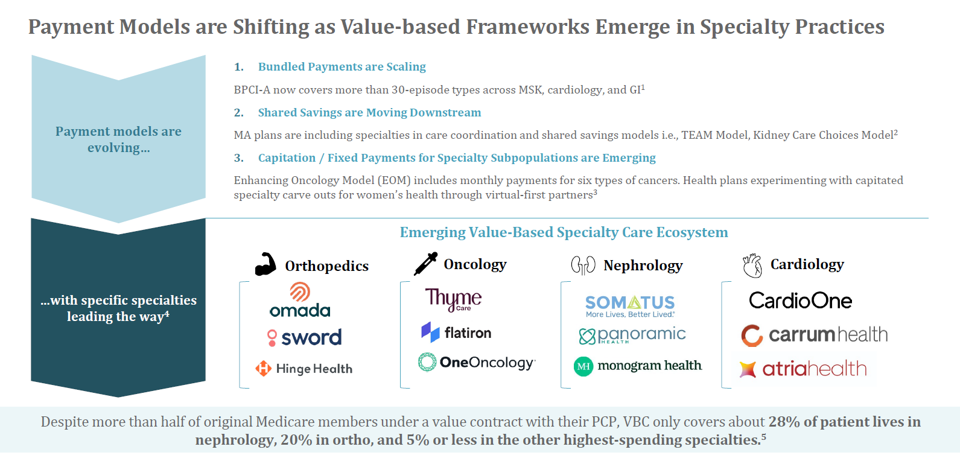

- Payers and employers are launching joint ventures and entering into risk-based contracts to better align on specialty spend and quality benchmarks.

- Stakeholder alignment and financial models that incorporate capitation, shared savings, and bundled payments will drive the next phase of platform innovation, pushing solutions to deliver operational ROI within one to two years.

Key Market Segments and Notable Activity

- Digital Front Door and Referral Platforms: Over 77% of consumers prefer to start care digitally, but fewer than 40% of provider organizations have cohesive digital intake. Investing in robust “front door” infrastructure is now table stakes.

- Care Navigation and Coordination: The stakes in managing referral leakage have increased, with 55-65% of specialty referrals sent out-of-network. Navigation platforms that reduce leakage and enable in-network retention are demonstrating measurable financial lift for provider organizations.

- Virtual and Hybrid Specialty Care: IPO and large growth financings in virtual-first specialty care platforms show strong investor confidence in models that integrate digital, home, and in-clinic care.

Emerging Sub-Sectors to Watch

- Orthopedics, Oncology, Cardiology, Women’s Health, and Behavioral Health are leading growth and innovation, with episode-based VBC adoption and virtual care channels scaling rapidly.

- Employer solutions focused on specialty navigation and claims analytics are expanding, as employers grapple with high-cost cases and demand ROI-driven benefit optimization.

- Risk-bearing specialty care enablement platforms are surfacing, helping both providers and payers manage the regulatory, actuarial, and workflow complexities of shared-risk contracts.

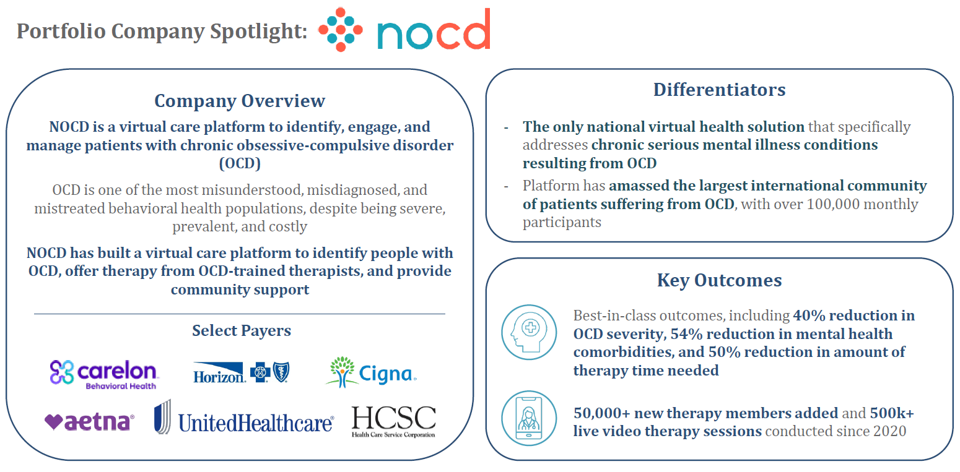

Portfolio Case Study: NOCD

HEP portfolio company NOCD stands out as a differentiated platform redefining virtual care for obsessive-compulsive disorder (OCD). With a thriving community of more than 100,000 members and industry-leading outcomes – patients see a 40% reduction in symptom severity and a 54% improvement in related conditions – NOCD showcases the power and scalability of focused digital specialty care. Its success underscores the market momentum behind targeted platforms addressing high-burden, under‑served conditions.

Our Predictions and Concluding Thoughts

- As specialty care spend approaches 40% of U.S. medical spend, demand for automation, intelligent routing, and team-based navigation will only intensify.

- Value-based payment models – including the new CMS TEAM Model and capitated carve-outs – will call for solutions that manage all aspects of referral capture, multidisciplinary care, contracting, and regulatory compliance.

- The next generation of winners will be those that can demonstrate measurable ROI, embed within customer workflows, and proactively meet interoperability standards to coordinate across fragmented networks.

In a rapidly evolving environment, health plans and their technology partners who invest in truly integrated, compliance-first specialty access solutions will be best positioned for operational resilience and market differentiation.

Want to Learn More?

Each year, HEP caucuses with its advisors and executive partners to evaluate the evolving healthcare and growth equity landscape, with the goal of determining our investment agenda of eight-to-ten themes for further exploration. Of these Areas of Focus, we select four for our market sector road mapping exercise. This content was excerpted from our Specialty Care Access and Innovation sector roadmap. To learn more about our sector roadmaps and other thought leadership initiatives, please contact jlaurash@hepfund.com.