Goals of Strategic Investing Programs

Over the past 10 years, HEP has conducted a deep dive into the meteoric growth of payer, provider, and pharma-sponsored investment and innovation funds. In our most recent work, we bolstered our study with a set of surveys to fund leaders and the CEOs who have raised strategic capital.

In the course of our examination, we found that strategic investing leaders including Blue Cross Blue Shield Massachusetts (BCBS MA) set four distinct goals in operating their investment programs. These include the following:

- By taking equity stakes in early-stage companies, health plans and providers can generate new sources of income that are not subject to the revenue and cost pressures affecting the core business.

- From an operational perspective, innovation programs offer plans and providers a means to identify a pipeline of promising companies that can help improve efficiency, reduce medical costs, elevate outcomes, and expand access.

- We see a number of plans and providers launching these programs as a vehicle to enhance brand integrity and expand market reach in an increasingly competitive, consolidating landscape.

- Making a commitment to commercializing new ideas through a strategic investment group cultivates a culture of innovation, which yields long-term competitive advantages.

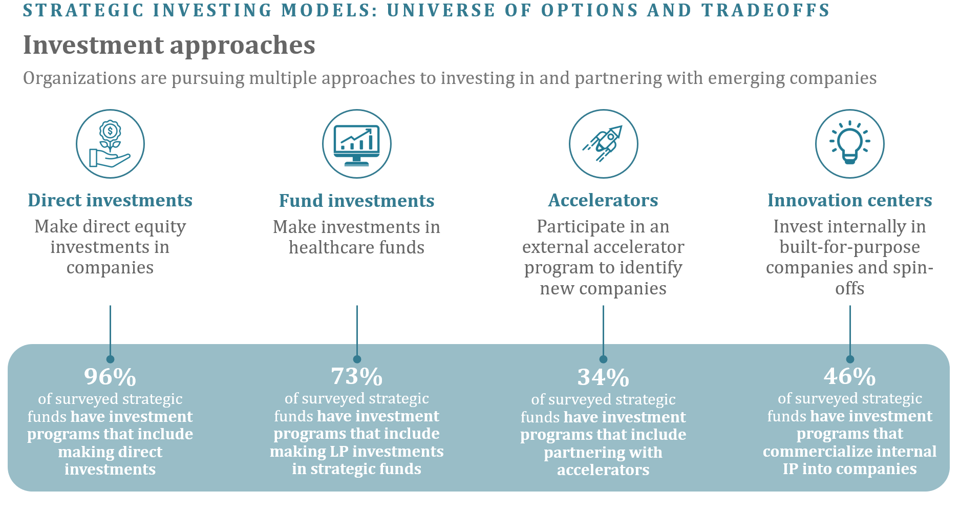

In HEP’s assessment, how an institution differentially weighs these goals is a key a consideration in determining which combination of investment approaches—direct investments, LP investments in strategic funds, partnership with a third-party accelerator, development of a built-for-purpose innovation center—are best suited to that organization’s needs. The effective matching of investment approaches to an institution’s idiosyncratic goals and resources are clear criteria of success of the highest performing investment and innovation programs.

BCBS MA serves as a clear example of a well-honed strategic investing approach. Michele Courton Brown, Chief Talent Equity Officer, Blue Cross Blue Shield of Massachusetts says, “Whether it is clinical or operational solutions, we seek to connect the capabilities of innovative solutions being developed by HEP portfolio companies – solutions that would be costly and time consuming to replicate – to meet our organization’s and ultimately our member’s needs.” Blue Cross Blue Shield of Massachusetts’ commitment to ensuring its members have access to high-quality, affordable, and equitable health care with an unparalleled consumer experience serve as guiding principles for the organization. How does the organization innovate given many challenges including the increase in demand for behavioral health services, roadblocks to accessing care, and the burdens of fraud, waste, and abuse? Blue Cross Blue Shield of Massachusetts’ plan for innovation includes community partnerships, internal innovation and strategic investing.

BCBS MA has also held itself accountable to their investing goals. BCBS MA has seen sustainable financial returns even during choppy economic environments. They have also seen strong evidence of introducing innovation.

One example of innovation success has been strategic investing with Health Enterprise Partners (HEP), which pools funds from payers and providers across the country and then invests those funds in innovative healthcare growth stage companies. BCBS MA works with HEP to evaluate and consider adopting these innovations and has emerged as the leader in strategic investing innovation having developed partnerships with five HEP companies. Ezra Mehlman, Managing Partner of HEP, says, “Michele Courton Brown and the Blue Cross Blue Shield of Massachusetts team have cracked the code on outsourced innovation and they are a beacon for other payers. In large organizations, you need a concerted commitment to identify partnership opportunities and usher innovations through the process. BCBS MA has this in abundance.”

Structuring an Investment Program

After articulating investing goals, organizations need to design the investment program. Michele Courton Brown describes her organization’s approach as follows, “Our strategic investing is tied to BCBS MA’s corporate strategy and organizational priorities. We’ve employed a three-pronged approach of making direct investments where there is direct organizational engagement; investing in strategically aligned funds to expand our scale and to accelerate deployment of innovative solutions; and, co-investing with other Blues to improve operating margin or achieve efficiencies.”

Building Meaningful Portfolio Partnerships

BCBS MA’s success cementing meaningful innovation partnerships is evidenced by having more vendor agreements in place than any other HEP strategic limited partner.

Highlights of these partnerships include:

- Pioneering in-home addiction treatment solutions through Aware Recovery Care

- Availing world class virtual treatment for patients with OCD through rolling out NOCD

- Offering convenient, preventive care at the workplace through Catapult Health

- Reducing waste by leveraging Alivia Analytics’ technology platform

- Providing best-in-class care for the ABA community through partnership with Proven Behavioral Solutions

In 2021, BCBS MA strove to increase access to addiction treatment throughout Massachusetts. As a part of that ambitious initiative, the organization chose Aware Recovery Care as one of their key behavioral health partners. With the goal to expand treatment into the home, Aware was featured in plan-sponsored employer conferences and literature. Additionally, BCBS MA introduced Aware to other innovative BCBS MA providers to provide patients with virtual primary care offerings, extending a seamless provider network. “Aware Recovery answers a fundamental question in mental health care: How do we meet the patient where they are?” said Dr. Greg Harris, a psychiatrist and senior medical director, behavioral health for BCBS MA. “Their novel in-home treatment and integrated approach allows them to offer a continuum of medical and mental health services that are optimized for each patient, and which can be intensified as needed,” said Harris, who led the work to include Aware in the insurer’s network. The breadth of the partnership impact is immense and serves over 1,100 members with 45,000 peer visits and has delivered over 4,500 psychotherapy and psychoeducation visits overall.

BCBS MA sees the need for greater understanding and care to those with Obsessive Compulsive Disorder (OCD). OCD is a highly treatable mental health condition that affects approximately 1 in 40 people around the world, but it remains widely misunderstood. NOCD provides effective, affordable, and convenient OCD therapy through video sessions. Steven Smith, NOCD CEO and co-founder says, “We are absolutely thrilled about the incredible progress we have made with BCBS MA to date. Through our collaborative efforts, we have paved a new path for the OCD community in Massachusetts, assuring them that they are not alone and that evidence-based Exposure and Response Prevention (ERP) Therapy is conveniently accessible.”

BCBS MA sees the need for greater understanding and care to those with Obsessive Compulsive Disorder (OCD). OCD is a highly treatable mental health condition that affects approximately 1 in 40 people around the world, but it remains widely misunderstood. NOCD provides effective, affordable, and convenient OCD therapy through video sessions. Steven Smith, NOCD CEO and co-founder says, “We are absolutely thrilled about the incredible progress we have made with BCBS MA to date. Through our collaborative efforts, we have paved a new path for the OCD community in Massachusetts, assuring them that they are not alone and that evidence-based Exposure and Response Prevention (ERP) Therapy is conveniently accessible.”

Employers are looking for ways to ways to keep their employees healthy and productive. Catapult Health specializes in supporting employers by providing virtual preventive exams for employees. In one example, Catapult Health worked with BCBS MA to service a national retailer for multiple years. Catapult helped increase preventive care compliance and provided a convenient and meaningful checkup experience for the retailer’s associates. BCBS MA is pleased to hear from associates who participated in a BCBS MA’s Catapult Health Checkup. One associate said, “Very good experience. I’m glad I went. Will take the advice of the team and start working on issues they identified”, and another said, “In my opinion, you are the best!”

Employers are looking for ways to ways to keep their employees healthy and productive. Catapult Health specializes in supporting employers by providing virtual preventive exams for employees. In one example, Catapult Health worked with BCBS MA to service a national retailer for multiple years. Catapult helped increase preventive care compliance and provided a convenient and meaningful checkup experience for the retailer’s associates. BCBS MA is pleased to hear from associates who participated in a BCBS MA’s Catapult Health Checkup. One associate said, “Very good experience. I’m glad I went. Will take the advice of the team and start working on issues they identified”, and another said, “In my opinion, you are the best!”

BCBS MA is proud that it has built one of the largest provider networks in the nation, with more than 67,000 clinicians. Still, there are those who accidentally or intentionally overbill and waste the plan’s resources. The scale of this misuse of healthcare resources is immense, with over $935 billion in Fraud, Waste and Abuse (FWA) in the U.S. healthcare system every year. BCBS MA engaged Alivia Analytics to identify potential Fraud, Waste, and Abuse and flag cases so that Massachusetts’ investigators can prioritize their follow-up and recovery. For another plan, Alivia supported recoveries of $2.2 million of improper payment in a single month. The recoveries for the month in which the health plan partnered with Alivia exceeded the amounts previously recovered on an annual basis. Alex Kormushoff, Alivia’s Chief Operating Officer, says, “Alivia Analytics is honored to have been selected to provide our Payment Integrity Platform and solutions to BCBS MA. The Alivia platform will provide the industry’s most effective solution to empower BCBS MA’s investigative staff with analytics backed by AI.”

BCBS MA is proud that it has built one of the largest provider networks in the nation, with more than 67,000 clinicians. Still, there are those who accidentally or intentionally overbill and waste the plan’s resources. The scale of this misuse of healthcare resources is immense, with over $935 billion in Fraud, Waste and Abuse (FWA) in the U.S. healthcare system every year. BCBS MA engaged Alivia Analytics to identify potential Fraud, Waste, and Abuse and flag cases so that Massachusetts’ investigators can prioritize their follow-up and recovery. For another plan, Alivia supported recoveries of $2.2 million of improper payment in a single month. The recoveries for the month in which the health plan partnered with Alivia exceeded the amounts previously recovered on an annual basis. Alex Kormushoff, Alivia’s Chief Operating Officer, says, “Alivia Analytics is honored to have been selected to provide our Payment Integrity Platform and solutions to BCBS MA. The Alivia platform will provide the industry’s most effective solution to empower BCBS MA’s investigative staff with analytics backed by AI.”

Autism Spectrum Disorder (ASD) has been identified in one in 36 children and the prevalence is increasing according to the CDC. “BCBS of Massachusetts has been a steadfast supporter and valuable partner for Proven Behavior Solutions,” says Proven’s CEO Scott Snider. Proven and their providers serve autistic children and their families in Southeast Massachusetts. In 2023 alone, Proven served 88 BCBS members and their families across 15,361 procedures. BCBS MA is Proven’s largest commercial payor, comprising almost one third of their business. Finding support and treatment for Autism can be challenging for families and BCBS of Massachusetts has engaged a partner that is making a difference. When asked of Proven’s patient families, “In the past six months, was your family’s quality of life improved by the services your child received?”, 96% said yes.

Looking Forward

Strategic investing presents the opportunity to deliver financial returns, while cultivating a pipeline of innovative companies that are responsive to the highest priority pain points affecting an organization. In structuring a strategic investing program, executives have multiple options accessible to them, from making direct venture investments, to investing in strategic funds, striking warrant deals with startups, and developing an internal innovation center. A clear understanding of how individual investment approaches further an institution’s specific financial and strategic goals is imperative to the success of any program. In this endeavor, executives would be well-served to study the example of BCBS MA and other leaders who have unlocked unique value from their strategic investing and innovation efforts.

Note: HEP’s study of this category, “Delivering on the Strategic Investing Promise: Options, Best Practices and Pitfalls to Avoid,” can be made available upon request.