Centers for Medicare & Medicaid Services (CMS) iterated critically important updates in its 1,327-page 2024/2025 Federal Register document. The Rebellis Group, part of Toney Healthcare, has done the painstaking work of reading every word to mine the key takeaways. Please note the findings from the recent the Part D redesign and rate summaries below.

CMS’s Final CY 2025 Part D Redesign Program: The Big Five Takeaways

On April 1, 2024, the Centers for Medicare and Medicaid Services (CMS) issued the final Calendar Year (CY) 2025 Part D Redesign Program Instructions, providing detailed guidance on the implementation of the Inflation Reduction Act of 2022 (IRA). The IRA aims to enhance prescription drug benefits, lower drug costs, and stabilize premiums for Medicare beneficiaries. The key takeaways from this guidance include:

1. Updated Standard Part D Drug Benefit: For CY 2025, the Part D benefit structure will include three phases: annual deductible ($590), initial coverage (25% coinsurance), and catastrophic coverage (no cost-sharing for enrollees). Sponsors and manufacturers will share the costs in varying proportions across these phases.

2. Previously Implemented IRA Benefits: Continuation of benefits such as no cost-sharing in the catastrophic phase, participation in the Medicare Prescription Payment Plan (M3P), no cost-sharing for ACIP-recommended adult vaccines, and a $35 monthly cap on insulin costs.

3. Creditable Coverage: CMS will provide subsidies to sponsors of retiree prescription drug plans that meet or exceed the actuarial value of standard coverage. The definition of creditable coverage now includes IRA-mandated discounts, and the simplified creditable coverage determination methodology will continue to mitigate market disruptions.

4. True Out-Of-Pocket Costs (TrOOP): Updates to TrOOP calculations will include payments for previously excluded supplemental benefits and exclude payments under the new Discount Program. This change ensures accurate determination of when beneficiaries reach the catastrophic coverage phase.

5. Specialty Tier Cost Sharing Thresholds: CMS will establish new cost-sharing methodologies for specialty tiers to reflect the redesigned Part D benefit. For CY 2025, coinsurance will be set at 25% after meeting the deductible and before reaching the $2,000 out-of-pocket threshold.

These changes, effective January 1, 2025, are designed to provide significant financial relief and improve access to prescription drugs for Medicare beneficiaries.

Full Rebellis report here: https://www.rebellisgroup.com/post/cms-s-final-cy-2025-part-d-redesign-program-the-big-five-takeaways

CMS’s CY 2025 Rate Announcement: Key Takeaways

On April 1, 2024, the Centers for Medicare and Medicaid Services (CMS) released the Calendar Year (CY) 2025 Medicare Advantage (MA) Capitation Rates and Part C and Part D Payment Policies. This announcement aligns with CMS’s vision of advancing health equity, comprehensive person-centered care, and promoting Medicare program sustainability. Key points include:

1. Growth and Revenue: The finalized effective growth rate is 2.33%, with an average payment increase of 3.7%. Adjustments were made based on updated FFS payment data from Q4 2023.

2. Part C Risk Adjustment: CMS will continue the phased implementation of the updated risk adjustment model, blending 67% of the 2024 model with 33% of the 2020 model. A more sophisticated normalization methodology will be used to address COVID-19 impacts.

3. Part D Risk Adjustment and the Inflation Reduction Act (IRA): Updates to the Part D risk adjustment model reflect changes from the IRA, including the $2,000 annual cap on true out-of-pocket (TrOOP) spending and the new Manufacturer Discount Program. These changes are crucial for accurate plan bids for CY 2025.

4. Puerto Rico: Policies for CY 2025 aim to maintain stability in the MA program in Puerto Rico, basing MA county rates on higher costs of dual-eligible individuals and adjusting for zero claims propensity. Puerto Rico has a higher proportion of Medicare beneficiaries enrolled in MA than any other state or territory.

5. Star Ratings: Updates include disaster adjustment lists, non-substantive measure specification updates, and measures for the Part C and D Improvement measures and Categorical Adjustment Index for 2025 Star Ratings. MA and Part D organizations must request CMS or IRE reviews of Part C appeals data or CTM data by June 28, 2024, for 2025 Star Ratings.

The full announcement is available for review here, and policies in the Advance Notice not modified or retracted will be effective for CY 2025.

Full Rebellis report here: https://www.rebellisgroup.com/post/cms-s-cy-2025-rate-announcement-key-takeaways

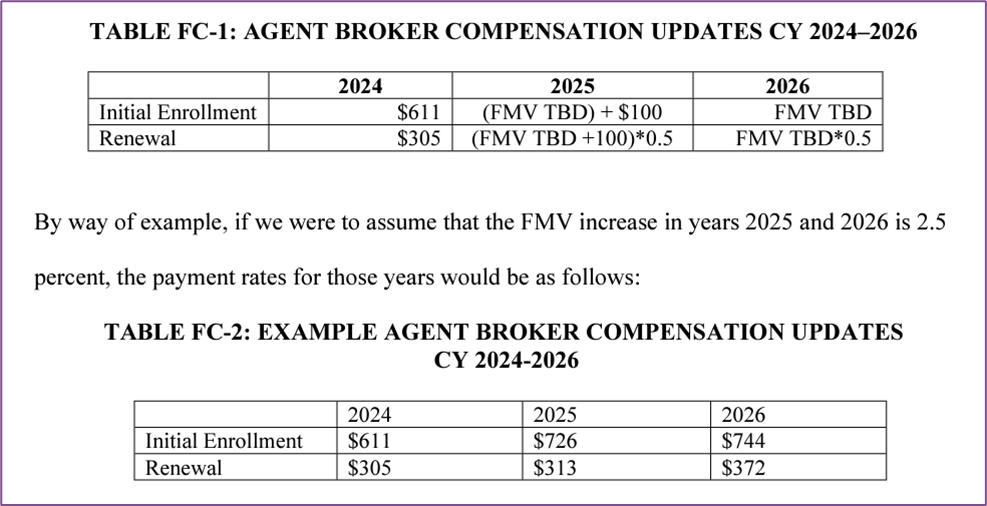

CMS’s CY 2025 Final Rule: A Quick Summary

On April 4, 2024, the Centers for Medicare and Medicaid Services (CMS) published a final rule revising regulations for the Medicare Advantage (MA), Medicare Prescription Drug Benefit (Part D), Medicare cost plan, and Programs of All-Inclusive Care for the Elderly (PACE) for Contract Year 2025. This rule introduces significant changes in several areas, including Star Ratings, marketing and communications, agent/broker compensation, health equity, dual eligible special needs plans (D-SNPs), network adequacy, and codification of existing sub-regulatory guidance from the Contract Year 2024 proposed rule. Key changes include a revised compensation structure for agents and brokers to prevent steering practices, restrictions on the distribution of personal beneficiary data by Third Party Marketing Organizations (TPMOs), requirements for annual health equity analyses by Utilization Management committees, and new notification rules for supplemental benefits. Additionally, the rule updates the Special Election Period (SEP) for dual eligible beneficiaries and modifies the Medication Therapy Management (MTM) program’s eligibility criteria. Enhancements to behavioral health provider access standards are also included. These changes aim to improve beneficiary protections, promote equitable access to care, and enhance program transparency and efficiency. Organizations must swiftly adapt to these new requirements, which will be effective for the 2025 Contract Year.

Full Rebellis report here: https://www.rebellisgroup.com/post/cms-cy25-final-rule-a-quick-summary

In April 2024, Toney Healthcare, a clinically oriented consultancy and provider of utilization management, care management and quality improvement services to health plans nationwide, merged with the Rebellis Group. The Rebellis team of industry experts has established its reputation as a leader in the Medicare Advantage management consulting realm. The partnership with Toney Healthcare is highly complementary, bringing together Toney Healthcare’s expertise in clinical operations with Rebellis’ expert model consulting services.