Each year, HEP caucuses with its advisors and executive partners to evaluate the evolving healthcare and growth equity landscape with the goal of determining our investment agenda of ten themes for further exploration. Of these Areas of Focus, we select four for our market sector road mapping exercise. This content was excerpted from our Outsourced Non-Core Services sector roadmap. To learn more about our sector roadmaps and other thought leadership initiatives, please contact jlaurash@hepfund.com.

The question of whether to outsource various departments and services has repeatedly emerged within HEP’s strategic payer and provider LP network as both a control lever for administrative burden and cost containment as well as a mechanism to capitalize on technological advancements and best-in-class solutions. While many organizations have historically been reticent to outsource, the ability of outsourced services to convert fixed costs into variable costs, bridge skill gaps, access and retain talent, and afford concentration on core competencies has made the option increasingly desirable. The sector is poised to embrace solutions fulfilling the expanding scope of workflows that healthcare organizations are willing to shift externally. Tailwinds supporting growth in outsourcing spend have created an attractive environment for new service providers, driving efficiencies for key stakeholders – we believe this will continue to spur interest and investment in the space.

The Need for Outsourced Non-Core Services

Growing importance has been placed on outsourced non-core services as a “perfect storm” of margin pressures, supply costs, labor shortages, and volume changes is leading many to consider outsourcing across an array of services and lines of business.

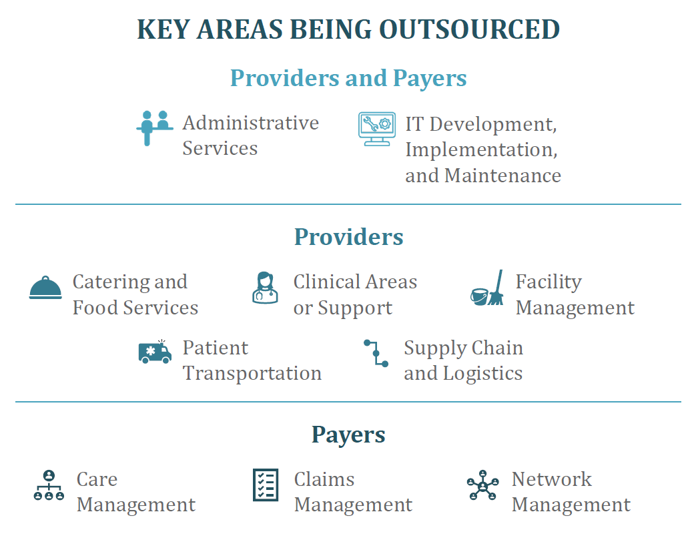

Outsourcing non-core services involves the contracting of third-party vendors or service providers to handle any clinical or non-clinical business functions not directly related to core operations. Many providers and payers are turning to outsourcing to delegate time-consuming, resource-intensive tasks to external vendors, take advantage of variable cost structures, and access specialized skillsets and technology without direct investment.

Market Tailwinds

Mounting Financial Pressures: The healthcare industry spent $82.7 billion on nine key administrative functions in 2022 – a 50% increase over the previous year – with healthcare system spend on non-core administrative processes accounting for 25% of national healthcare industry expenditures. While these fixed costs have a substantial impact on increasingly thin margins, providers and payers are revisiting traditional and novel medical management cost levers. Outsourcing non-core clinical and non-clinical processes allows these organizations to convert these to variable costs while maintaining high levels of customer service.

The Labor and Staffing Crisis: The pandemic exacerbated staffing shortages in hospitals, increasing the demand for contract healthcare workers and outsourcing as a solution to manage fluctuations in patient volumes and to alleviate administrative workloads. Meanwhile, today’s talent scarcity threatens the ability of payers to deliver on day-to-day core services. Outsourcing can supply hard to find expertise, such as tech and clinical resources, and can eliminate redundant management layers, thereby focusing internal talent on supporting core service delivery rather than non-core tasks.

Technology’s Rapid Advancement: The rapid adoption of generative AI and other novel technologies across various industries is prompting providers and payers to explore their value in healthcare, particularly due to the efficiency and cost savings they offer. However, these technologies require substantial expertise and high costs to develop in-house, potentially leading to technology implementation that lags behind the latest advancements. Outsourced services vendors often leverage cutting-edge technologies such as AI, data analytics, and telemedicine. These vendors offer innovative and efficient solutions that make them attractive partners for health systems and payers seeking to enhance operational efficiency and patient/member care through technology.

Meeting the Call for Consumerism: The measure weight of the patient experience/complaints and access measures in Medicare Advantage Star ratings doubled from a weight of 2 in 2022 to a weight of 4 in 2023. As providers and payers increasingly focus on engaging patients as “consumers,” and as patients become more accustomed to seamless user experience in other industries, improving transparency and convenience from the patient’s perspective is critical. Specialized vendors have begun to emerge, providing providers and payers with more favorable, faster experiences which can drive patient and member retention.

HEP Portfolio Company Case Studies

HEP has made eight investments in outsourced non-core services to-date. As we continue to identify opportunities, we believe the greatest opportunities for investment lie in services that have clearly demonstrable, immediate ROI to customers, fill key talent gaps, and are distinctly specialized in solutions that fulfill the expanding scope of workflows healthcare organizations are newly willing to shift externally.

Provider Case Study: InterMed Outsourced Clinical Engineering for Providers

TidalHealth successfully created a healthcare technology management (HTM) program and improved system efficiency via partnering with The InterMed Group, an HEP portfolio company that offers health systems a cost-effective outsourcing option for the maintenance of biomedical equipment.

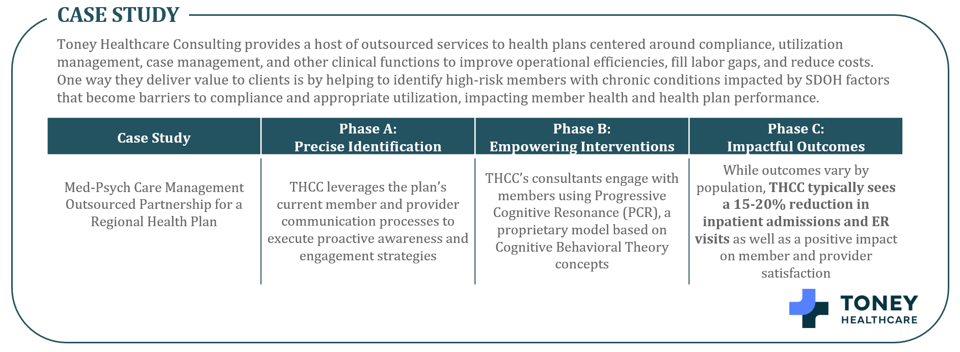

Payer Case Study: Toney Healthcare Consulting Outsourced Operational Support

By assisting health plans in optimizing operations, reducing costs, and saving time, outsourcing drives increased member satisfaction and enables value-based care models to succeed for plans of all sizes. Toney Healthcare Consulting (“THCC”), an HEP portfolio company, provides a host of outsourced services to health plans. These services are centered around compliance, utilization management, case management, and other clinical functions which can improve operational efficiencies, fill labor gaps, and reduce costs. One way Toney delivers value to clients is by helping to identify high-risk members with chronic conditions impacted by social determinants of health (SDOH) factors that become barriers to compliance and appropriate utilization, which in turn affect member health and health plan performance.

Market Headwinds

Data and Security Risks: As security breaches soar, outsourcing can raise concerns regarding the security of medical information, given organizations could become reliant on external providers to handle such information. The recent cyberattack on Change Healthcare is one example of how security vulnerabilities have far-reaching effects across the healthcare ecosystem due to its pervasive impact on a myriad of stakeholders.

Budgetary Limitations: Issues of network leakage, heightened labor costs, labor shortages, and lower patient volumes have impacted health system profitability, while thin margins and heightened rate resistance among employers and members are straining payer margins. Though outsourcing holds the potential to reduce costs, budgetary constraints may preclude providers and payers from taking the leap to outsource.

Quality Concerns: Apprehensions about quality and consistency of care, particularly when relying on external providers or patient/member-facing services, could potentially lead to variations in service that affect outcomes and efficiency. Further, coordination requirements can add strain on in-house employees.

Technological Fragmentation: Integration of clinical tools, claims systems, and other technology infrastructure across the healthcare ecosystem can be cumbersome for outsourcing vendors. These companies may face challenges navigating and streamlining across disparate systems, making successful implementation of their technologies a highly intensive task.

Market Segmentation

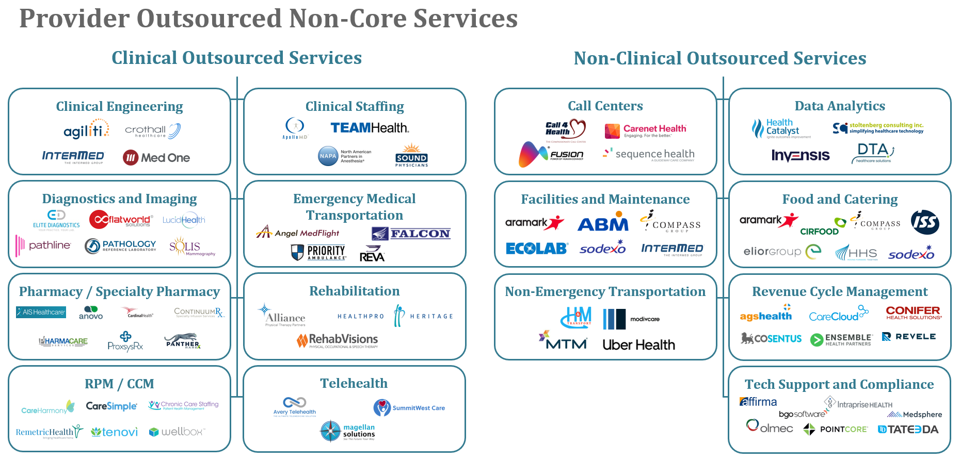

The outsourcing sector consists of provider and payer solutions that can be further delineated into sub-segments, each providing key areas for investment. These solution areas are detailed below with select key players in each segment.

HEP’s Predictions

For Providers

Given growing interest and current market dynamics, we at HEP posit that significant investment opportunity exists in the provider-facing outsourced non-core services market – particularly for roll-ups and outsourcing models featuring clear returns on investment. Roll-up opportunity is being driven by the hyper-fragmentation of outsourced providers serving the hospital space which rewards strategic consolidation. Vendor fatigue and a distinct lack of clear ROI among health systems who have become customers multiple times over also serves as a key driver for the outsourcing space as a whole. We believe outsourced partnerships can provide hard ROI due to their ability to staff and operate across key pain points such as clinical engineering, RCM, and infusion operations.

For Payers

Much like the provider market, we have observed greater receptivity from payers to partner with outsourcing vendors due to favorable market dynamics as they implement a more nimble, efficient workflow infrastructure across their organizations. Payer budgets for third-party vendor partnerships have remained robust, creating continued opportunity for differentiated solutions.

At the sub-sector level, we foresee continued outsourcing uptake across specialized clinical function staffing and solutions enabling a streamlined cost structure as the key opportunity areas. The widespread shortage of talent in clinical-oriented areas across payer organizations has caused specialized staffing to become a key issue for all payers, while the current economic environment has prompted payers to seek partnerships in areas offering increased revenue and cost efficiency generation.