The Rise of Clinical Efficiency Tools

The question of how to optimize clinical workflows is a sharpening focal point for HEP’s provider and payer LP network, driven by the pressures of labor shortages and rising operational costs, alongside the continued desire to elevate the quality of and access to care. While healthcare organizations have traditionally relied on legacy systems, the demand for dedicated clinical efficiency tools has surged as these solutions enable streamlined operations, enhance patient care, and alleviate the administrative burden on clinicians. These tools empower providers and payers to address inefficiencies, automate labor-intensive processes, and bolster data-driven decision-making. As the healthcare sector increasingly prioritizes operational efficiency and value-based care (VBC), we anticipate that these potentially transformative solutions will continue to gain traction, sparking further innovation and investment across the sector.

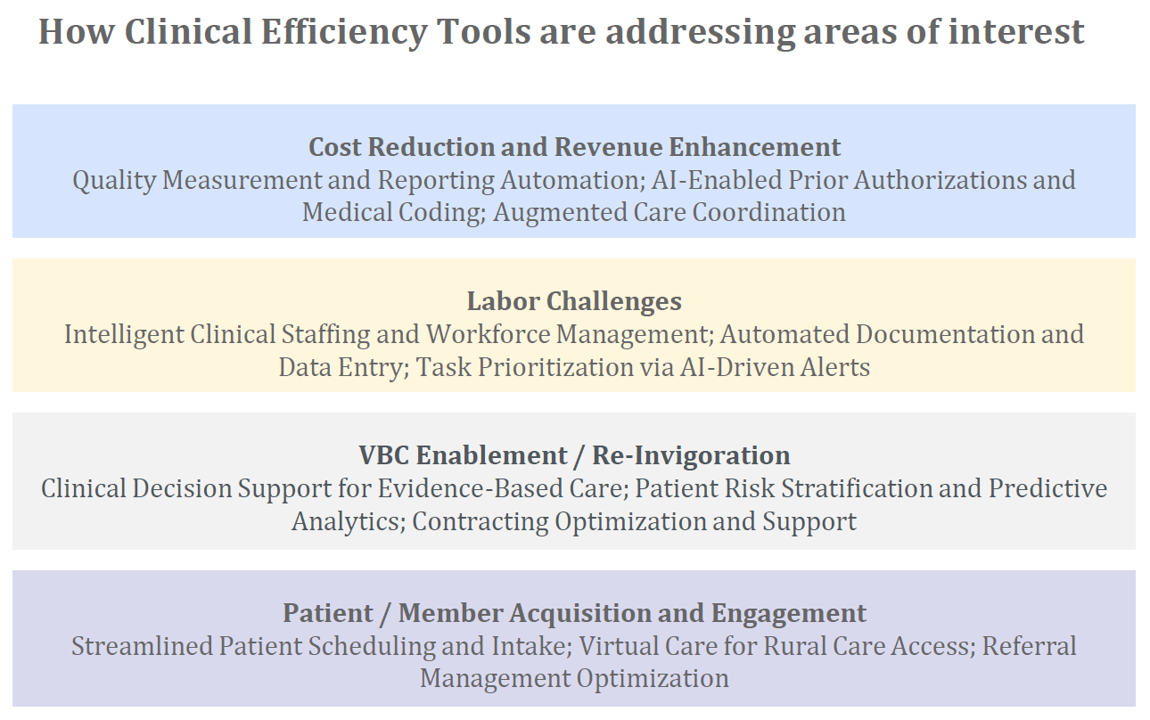

Each year, we accumulate perspectives on the current outlook of the HCIT and healthcare services markets from our network. Our 2024 Healthcare Executive Playbook Survey identified cost and revenue efficiency, labor challenges, VBC arrangements, and patient/member engagement as key priorities. Clinical efficiency tools are playing a pivotal role in turning these strategic priorities into actionable outcomes.

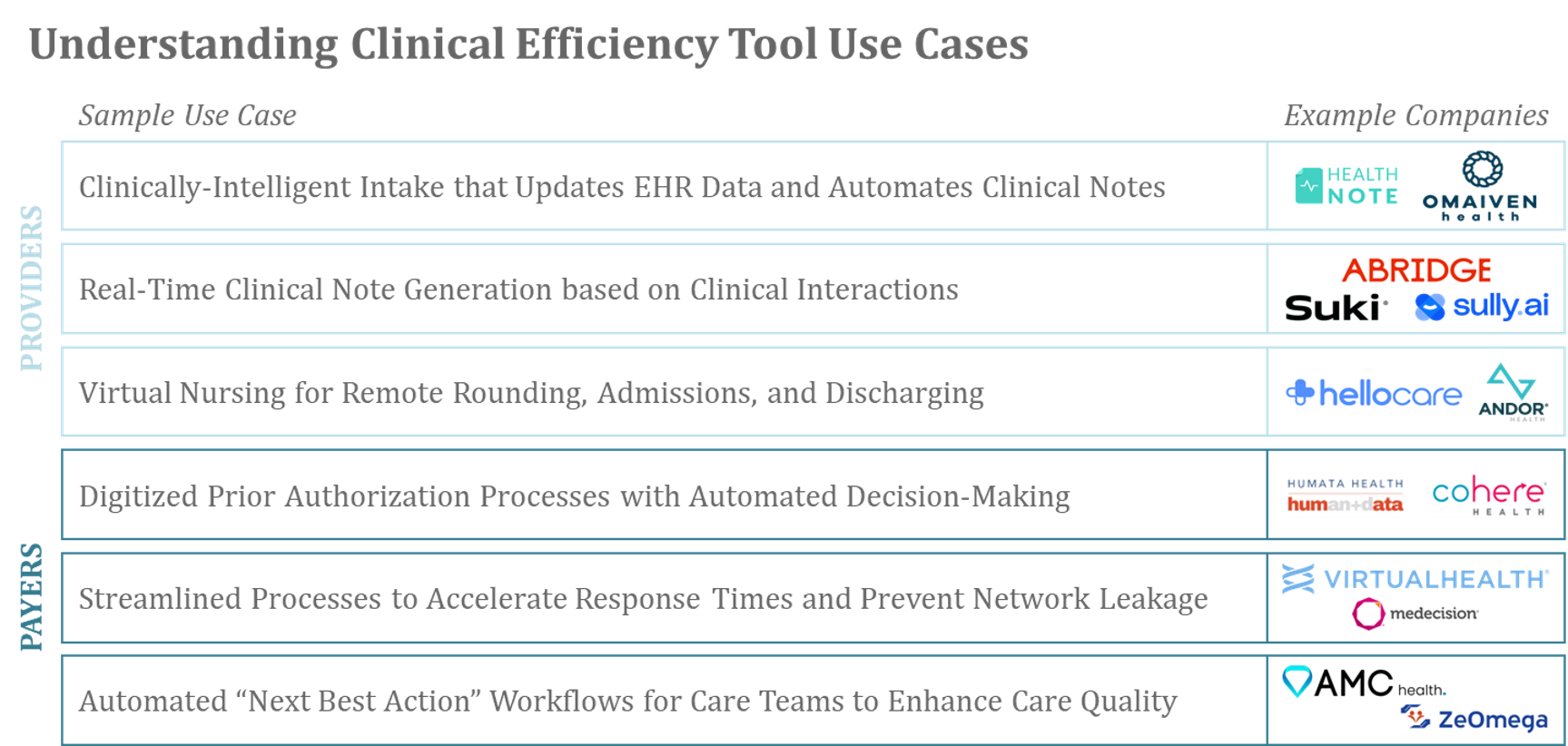

By leveraging these tools, providers can enhance patient throughput and reduce the time clinicians spend on non-patient-facing tasks, freeing them to focus on delivering care. In tandem, payers benefit by deploying these tools in areas such as member engagement, risk management, and claims processing.

The Future of Clinical Efficiency: Our View on Current and Future Market Attractiveness

Today’s Market

The Clinical Efficiency Tools market is crowded and competitive, with a diverse ecosystem of vendors, ranging from large corporations to innovative startups. To stand out, key players are focusing on product differentiation, user experience, interoperability, and data security. While 82% of providers note interest in third-party clinical efficiency tools, nearly two-thirds are looking to existing vendors first, highlighting the challenges new entrants face.

Simultaneously, advancements in generative AI, natural language processing, and predictive analytics are creating a new wave of technology. These innovations have the potential to disrupt market dynamics, enabling new entrants to establish their presence while dramatically improving tools that streamline workflows, reduce administrative burdens, and improve patient care outcomes.

Market Outlook

Looking ahead, we project the demand for clinical efficiency tools will grow. Digital transformation, evolving care delivery models, and the increasing adoption of VBC models will continue to drive the need for operational efficiency. We believe that clinical efficiency tools will be at the forefront of healthcare innovation, enabling personalized care pathways, predictive risk stratification, proactive disease management, and more. Players who achieve these capabilities are well-positioned to capture significant market share.

HEP’s Predictions for the Provider-Facing Market

We see significant opportunity in the provider-facing clinical efficiency tools market, especially for solutions with demonstrable ROI and clear differentiation – particularly those addressing areas not readily covered by EMRs or internal IT teams. Increasing standardization of AI technology is rapidly diminishing differentiation for startups, as health systems and EMR vendors are more easily able to implement their own solutions, highlighting the need for unique specialization.

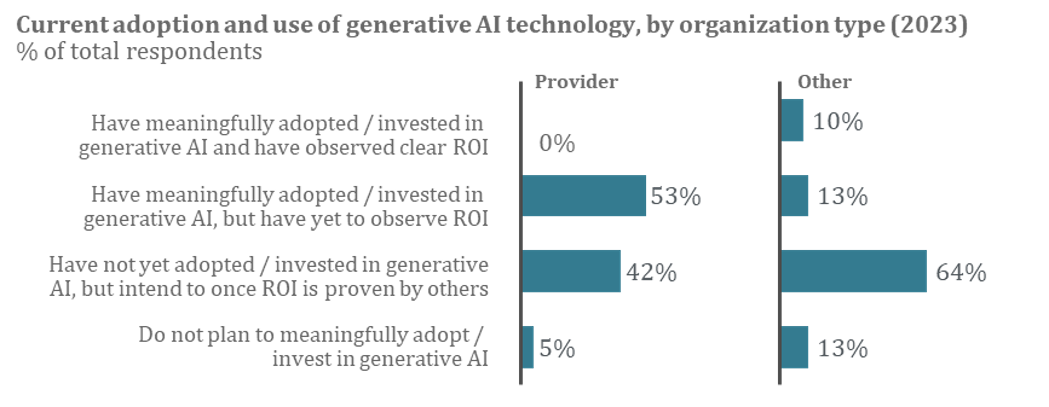

Further, the growing complexity of care delivery, coupled with workforce shortages and rising costs, has created a landscape where solutions directly addressing these pain points are essential. Yet nascent technologies like generative AI and large language models are spurring a “wait and see” approach. Only 6.8% of healthcare organizations planning to leverage AI in the next six months (compared to 21.5% of leading sectors). This trend was further evidenced in our 2024 Healthcare Executive Playbook Survey, with 42% of providers indicating they plan to adopt AI once others demonstrate its effectiveness.

We trust that success will be found for offerings that have robust evidence of outcomes and efficiency gains to counter such “wait and see” attitude.

HEP’s Predictions for the Payer-Facing Market

Like providers, payers are increasingly willing to invest in clinical efficiency tools that streamline operations and drive cost control. Faced with growing pressures around cost containment and operational efficiency, payers are seeking partnerships that enable agile, automated workflows – especially in areas such as prior authorizations, claims processing, and utilization management. Those who adopt these tools are likely to gain a competitive edge by making their operations more responsive and efficient.

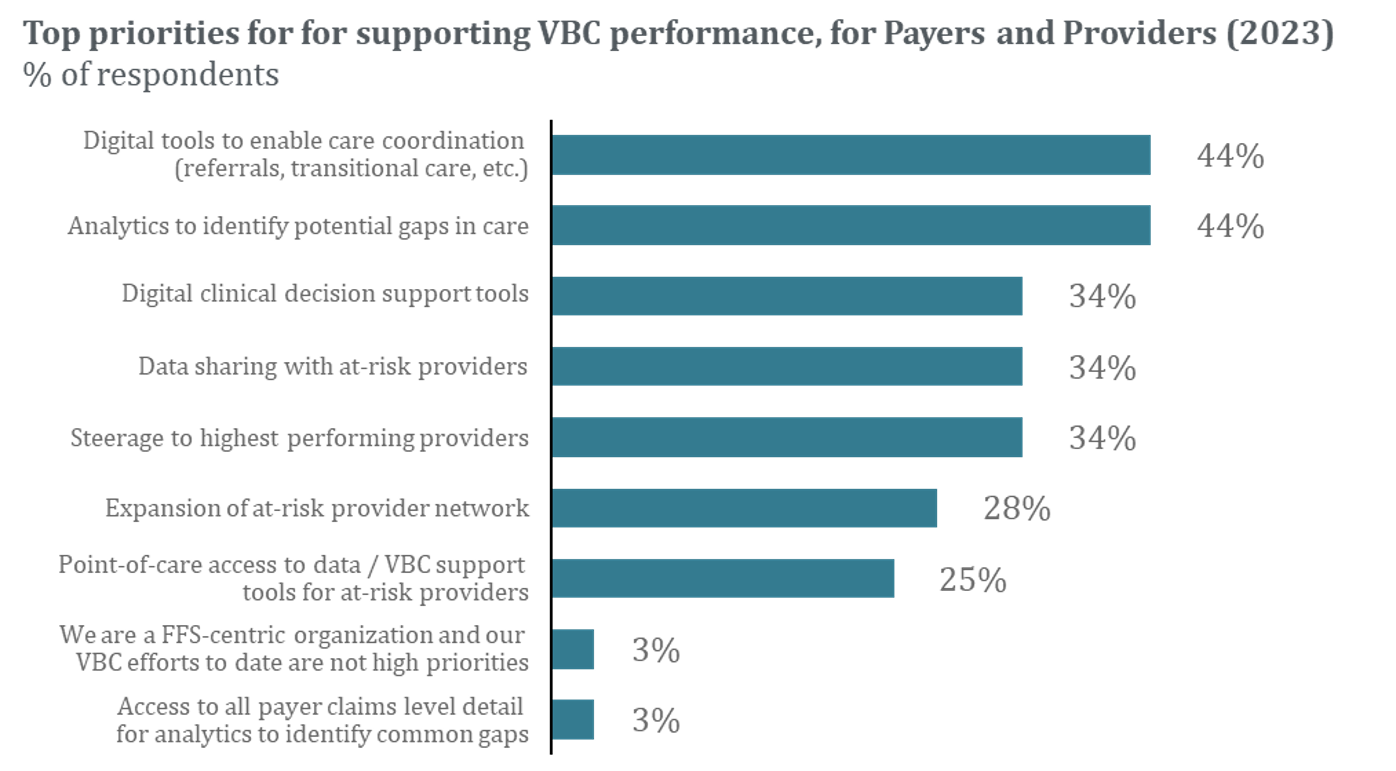

At the sub-sector level, data-driven insights and personalized member engagement are becoming key focuses. Payers are increasingly relying on advanced analytics to not only predict and manage patient risk but also to proactively shape cost structures and VBC contracts. This trend was highlighted in our 2024 Healthcare Executive Playbook Survey, with 44% of respondents prioritizing care coordination tools and care gap analytics to support VBC performance.

Additionally, as patient churn rises and consumer expectations shift, payers are rethinking their engagement strategies. Clinical efficiency tools that enable personalized interventions will be critical in this evolution, positioning payers as proactive health partners rather than transactional entities. This dual focus on operational efficiency and enhanced member engagement presents significant opportunities for solutions that address these emerging needs.

Want to Learn More?

Each year, HEP caucuses with its advisors and executive partners to evaluate the evolving healthcare and growth equity landscape, with the goal of determining our investment agenda of ten themes for further exploration. Of these Areas of Focus, we select four for our market sector road mapping exercise. This content was excerpted from our Clinical Efficiency Tools sector roadmap. To learn more about our sector roadmaps and other thought leadership initiatives, please contact jlaurash@hepfund.com.