HEP 2024 Reflections and Predictions

Each year, HEP formally surveys its strategic network to assemble perspectives on the current outlook of the healthcare IT and services market. This year we collaborated with L.E.K. Consulting on the development and analysis of our annual survey which included responses from 115 leaders of healthcare organizations and investment firms on their pain points, investment priorities, and strategic objectives.

Equipped with the output of this exercise, we caucused with 34 of our payer and provider limited partners during a two-day working session to set our 2024 Areas of Focus. Combining these thematic activities with our capital market perspectives, we are pleased to be releasing our insights in our 2024 Reflections and Predictions report. You can find a link to the full presentation here.

Key Survey and Discussion Themes

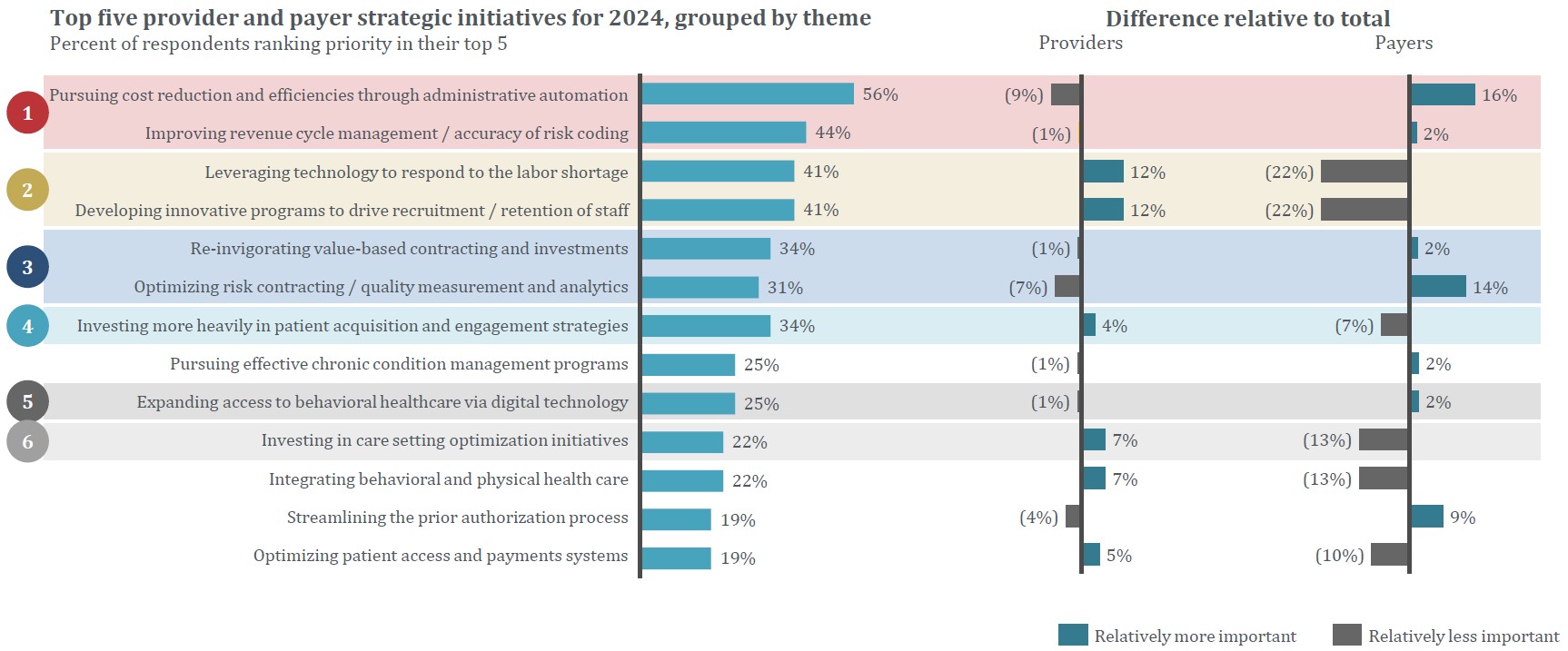

The core themes and strategic priorities for providers and payers that emerged through our surveying effort were: 1) cost reduction and revenue enhancement through administrative automation, 2) novel solutions to growing labor challenges, 3) re-invigorating and managing value-based care arrangements, 4) patient/member engagement, and 5) care setting optimization. These results underpin the challenges that our healthcare system faces but also highlight the clear opportunity for innovators to drive valuable change in the system.

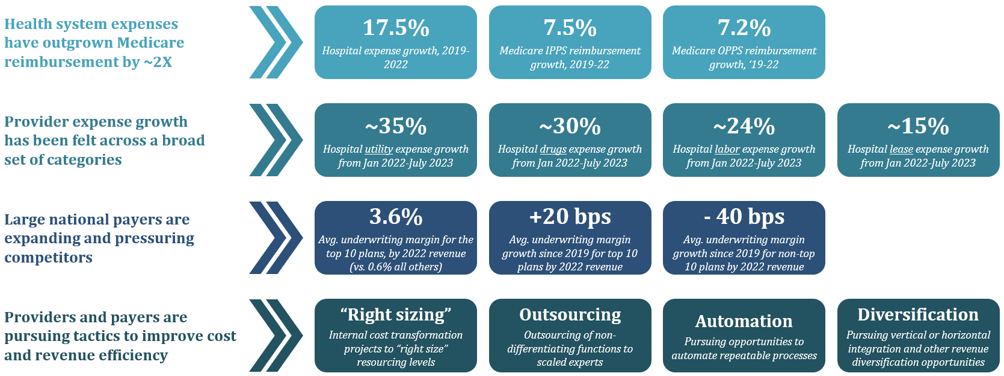

1. Cost Reduction and Revenue Enhancement

It is no secret that payers and providers have been grappling with cost and margin pressures in recent years. For providers, health system expenses have outgrown Medicare reimbursement by nearly two times. The growth in provider costs has been felt across a broad set of categories, including utilities, drug, labor, and lease expenses. For payers, competition from large national entities has squeezed margins for non-top-ten plans significantly. In response to these cost pressures, both providers and payers are turning to an array of strategies to drive down costs, including right-sizing, outsourcing, diversification, and automation of high-volume, repeatable activities.

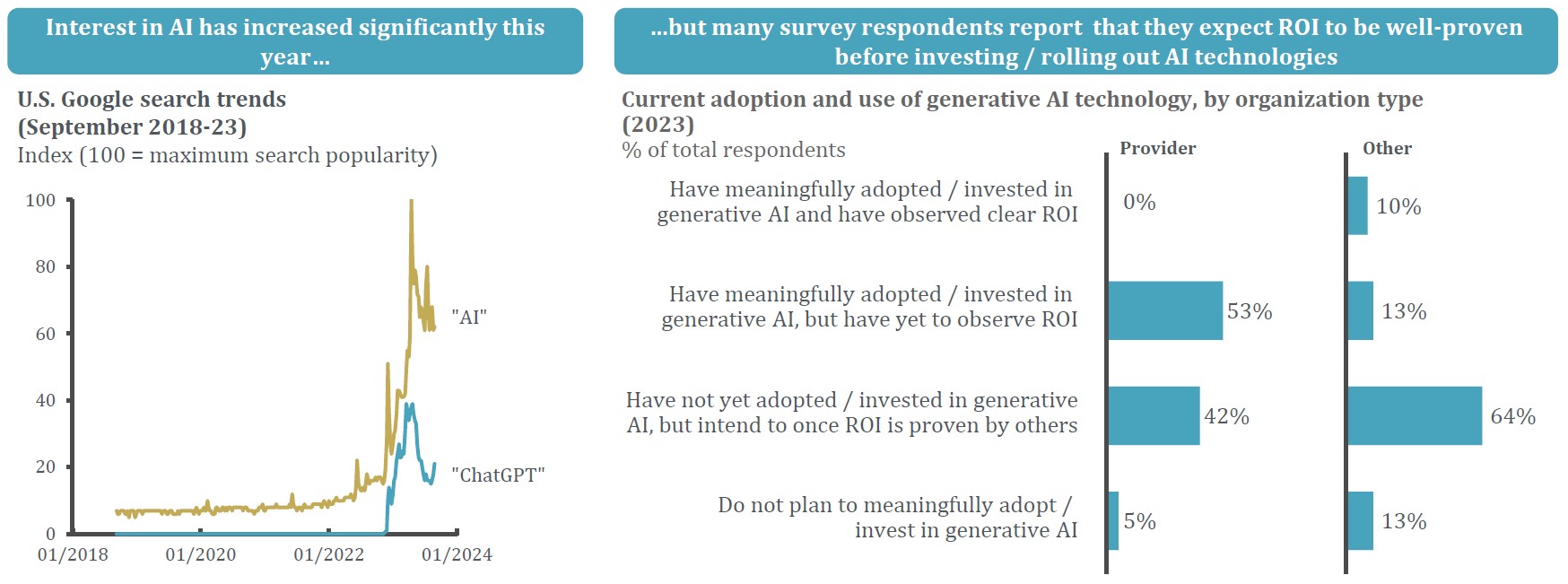

Respondents to HEP’s executive survey remarked on an interest in using AI take on some of those activities, particularly given the recent buzz around generative AI. However, in practice, many respondents are taking a “wait and see” approach – looking to others to prove out the ROI before investing in AI applications at their own organization.

Participants in our discussion session that followed mentioned the areas in which they have successfully adopted the use of AI have been narrow, focusing on specific use cases and specialties. Process-oriented workflows within hospitalist, rheumatology, and perioperative / OR scheduling were brought up as current AI use cases for health systems. Despite initial expectations of AI as a panacea for various healthcare challenges, its strength at present lies in these narrow applications where its analytical capabilities can be leveraged to the fullest in well-defined, algorithmic contexts.

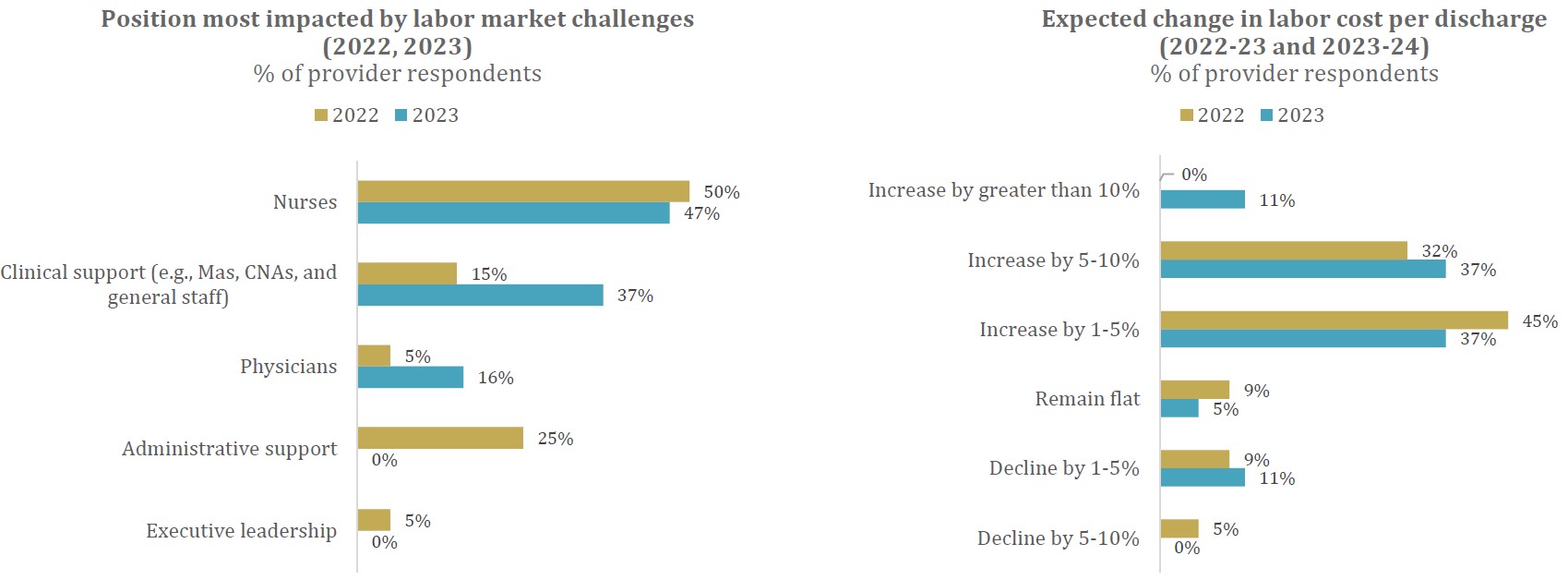

2. Labor Challenges

Provider and payer organizations are feeling the impact of labor shortages that have only accelerated in the wake of the COVID-19 pandemic. Over 60% of physicians experienced burnout in 2021 (vs. 44% in 2017), and with >40% of physicians expected to reach the age of 65 or older in the next 10 years, a shortage of 38,000 – 124,000 physicians is expected by 2034. Nursing shortages are expected to be an even more significant pain point in the coming years, with nursing shortage forecasts ranging from 150,000 – 400,000 registered nurses in U.S. hospitals by 2027. These workforce issues are significantly impacting access to care in our communities and are increasing costs for providers and payers as contract labor and temporary staffing wages continue to increase. Provider respondents to HEP’s survey confirmed these concerns, citing nursing and clinical support as key staffing shortage areas for 2024.

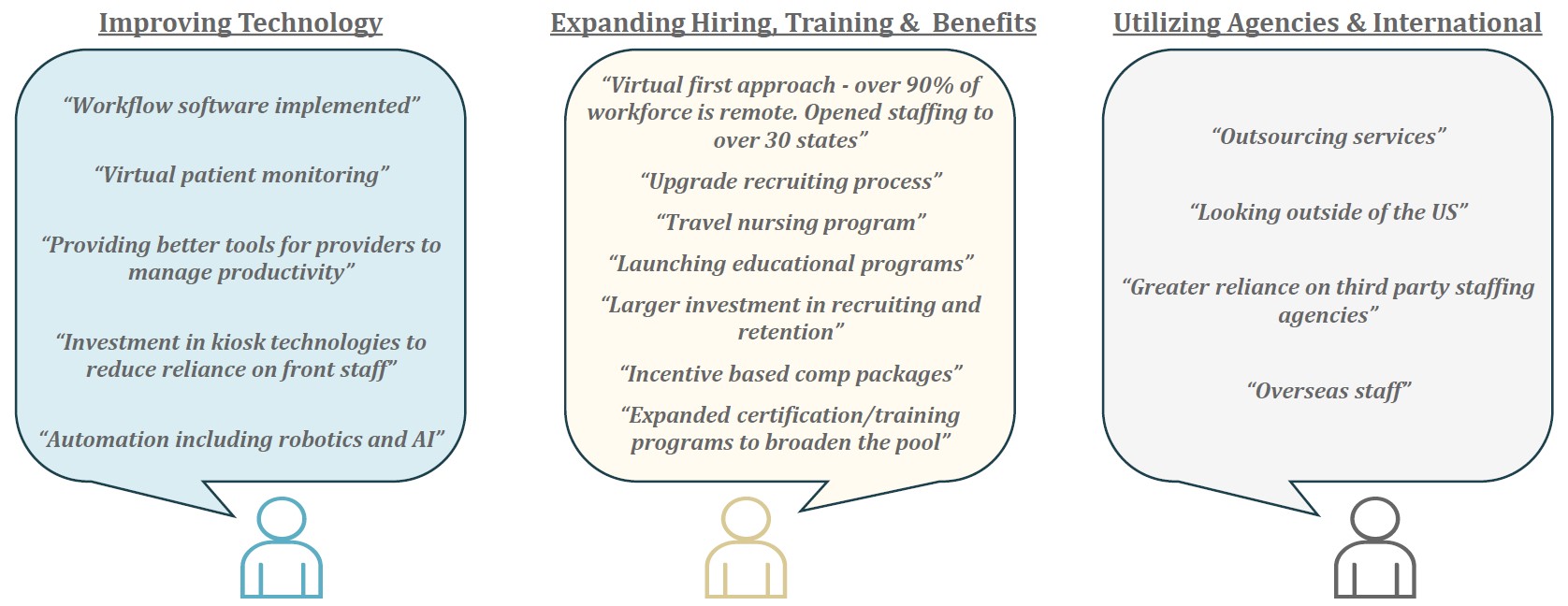

A multi-faceted approach to address these issues involves prioritizing education, enablement, and reduced burnout / increased joy for clinicians. Respondents have deployed a variety of tactics to address labor market issues, including implementing technology to drive workflow efficiencies, expanding hiring, training, and benefits, and utilizing agencies and offshore resources. Flexible scheduling and dynamic pay practices that maintain care continuity for patients are also possible solutions – certain successful models mentioned provide nurses with schedule flexibility and reduced burnout while efficiently allowing provider organizations to staff key departments. We expect nursing education and supply to be priority segments in the sector in the coming year, particularly given the proliferation of digital medical education and unique training models both in the U.S. and abroad.

3. Value-based Care Enablement

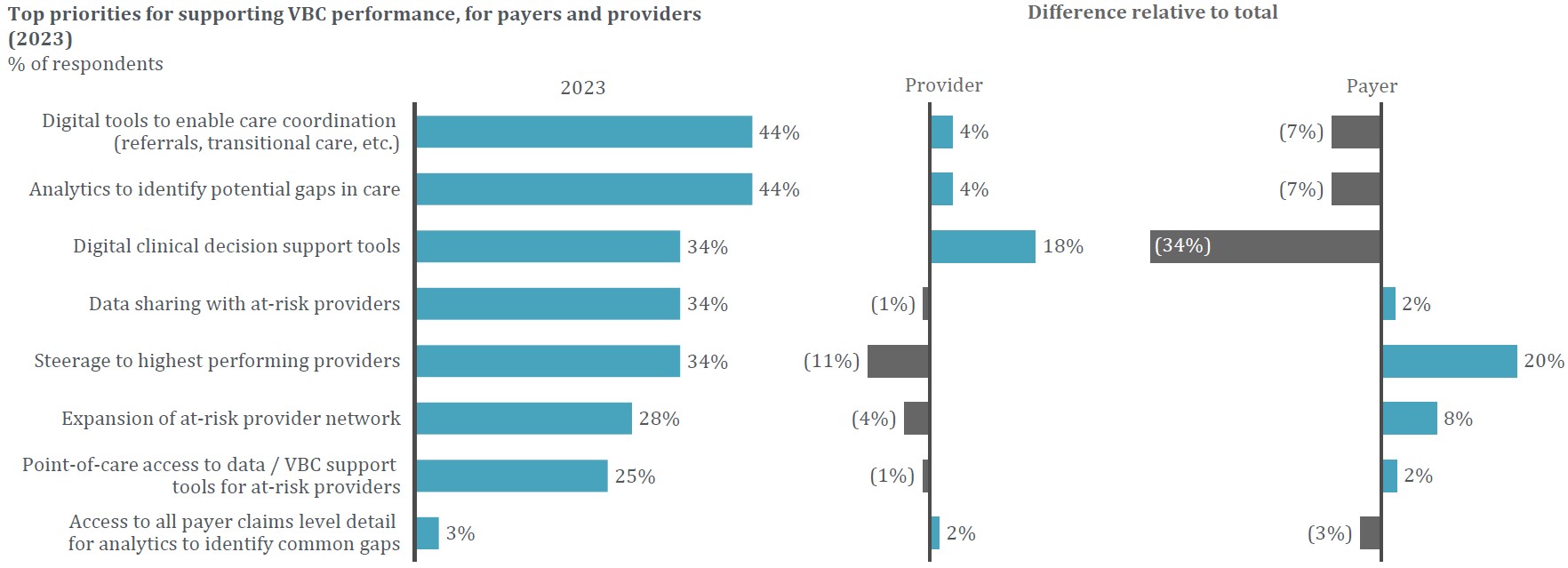

Both payers and providers understand the need to re-invigorate VBC efforts that have stalled in recent years. With >40% of 2022 physician payments made exclusively via FFS, it is clear that the industry-wide roll-out of VBC has lagged expectations. During our discussion, buyers of VBC solutions mentioned a level of vendor fatigue due to the number of solutions available, unclear ROI, and an inability to scale these efforts as hampering their adoption of value-based initiatives. Coupled with legacy claims systems that often present difficulties servicing outcomes-based relationships, these challenges make implementation and operation of VBC arrangements burdensome if not impossible. Claims system transformation services and EMR-oriented bundling technologies that align incentives, outcomes, and costs are well-positioned to enable more VBC relationships across claims systems. Non-profit organizations such as PACES (Patient-Centered Episode System) are making clinical definitions for episodes of care more standardized and can facilitate more efficient VBC contracting for payers.

4. Patient / Member Acquisition and Engagement

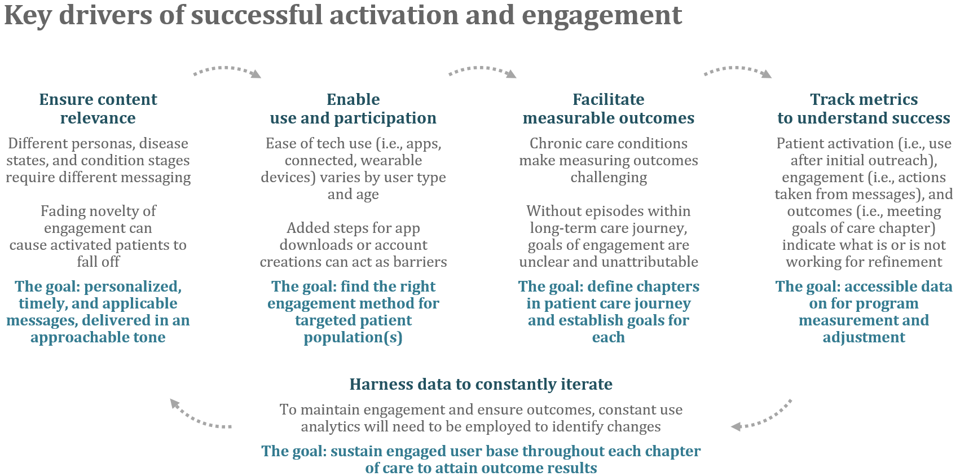

As consumerism in healthcare has become prevalent, competition for patients and members has increased and patients have higher expectations of their healthcare providers and insurance companies. Consumers are becoming more active in their care provider selection and are taking the time to research care providers online before booking – with 84% trusting those reviews as much as personal recommendations. In concert with this empowerment comes a changing landscape in which up to 45% of people are receiving care from a non-traditional venue, such as retail locations. Making sense of the growing number of care options has made adopting new strategies for acquiring and maintaining patients / members an imperative for healthcare organizations.

We heard from our network that retention is key. Success stories mentioned in our discussion group centered on vendors employing omnichannel yet targeted marketing strategies and data analytics to create focused engagement efforts for specific populations. Ultimately, there is a direct correlation between patient retention and overall patient lifetime value – studies have shown that a 1% increase in patient retention over five years yields to a 4% increase in total lifetime value.

5. Care Setting Optimization

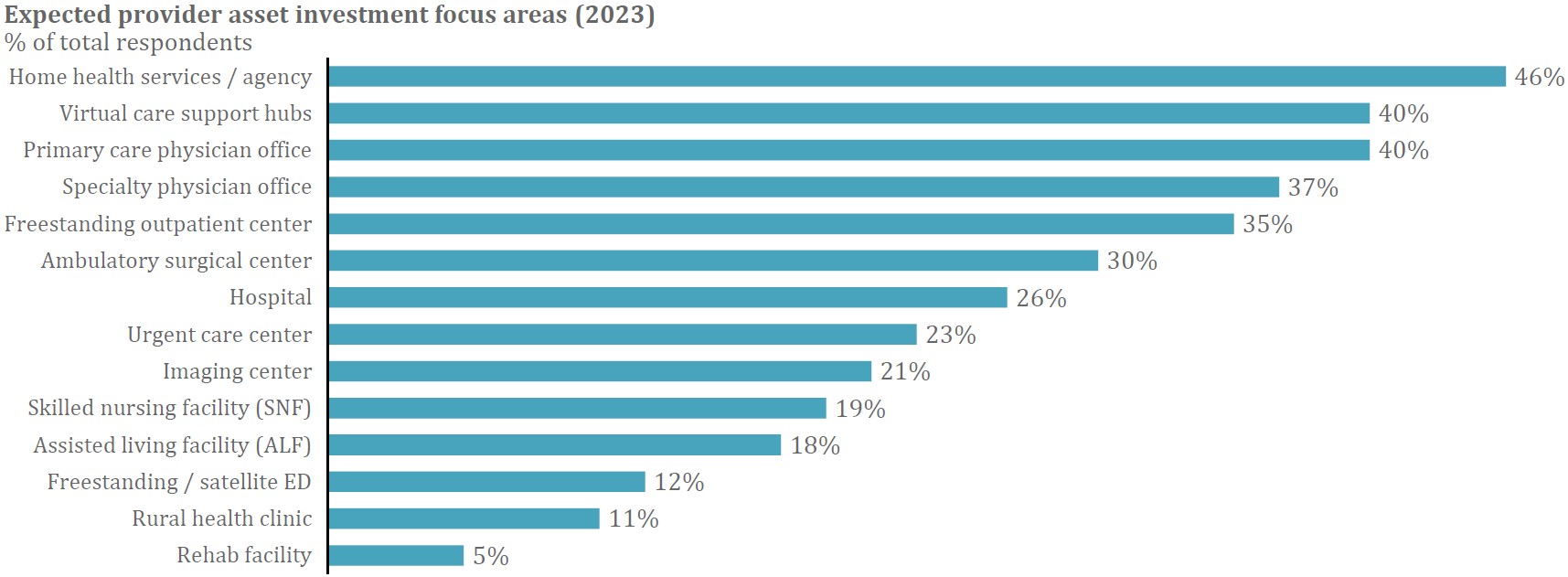

Home health and virtual care have remained investment focuses for the HEP network over the past several years as technological advancement has brought healthcare into the home more than ever before. The ability of home health programs to dramatically increase patient experience and quality of care scores while reducing costs of care is well-documented. As capacity issues continue to strain health systems, health at home services are becoming increasingly specialized and able to address higher-acuity patients. We expect the sector to remain a key investment area in the coming months, as confirmed by nearly half of provider respondents to the executive survey who selected home health services as the top area for investment focus in 2024.

Additional Focus Areas

- Solutions to improve Medicare Advantage Star Ratings – A key priority stated by payers in our survey was using digital tools to identify gaps in care for Star rating improvement. Given that health plan revenues can be significantly impacted by a rating below four-stars, business models that are focused on helping plans track, improve, and maintain stars scores represent particularly relevant opportunities for investment. Payers have been able to proactively address at-risk member populations with vendors providing targeted screening across metrics like diabetic retinopathy and blood pressure. However, the strong weighting of patient experience and access measures and the importance of CAHPS surveys underscore the need for solutions that can proactively identify and influence individuals who are at higher risk of dissatisfaction with their member experience.

- Innovative pediatric care models – Pediatric care remains one of the most fragmented sectors within healthcare. There is a significant opportunity for consolidation and transformation of care delivery to focus on exceptional pediatric care while providing increased convenience and flexibility to the child’s primary caregiver. New models discussed included the potential to compensate parents for their role in their child’s caregiving, on-demand offerings, and shifting the site of care to where it is most appropriate. We look forward to seeing more innovative companies in the space that challenge traditional pediatric care landscape.

- Digital prior authorization (PA) solutions – Given the January 2024 CMS ruling (effective 1/1/2026) requiring payers to implement an automated process for physicians to determine whether a prior authorization is required, identify PA information and documentation requirements, and facilitate the exchange of PA requests / decisions with provider IT systems, payers are going to have to adopt technologies that allows their organizations to meet these requirements. The ruling further states that payer organizations must provide a reason when denying a PA request, send standard PA decisions within seven calendar days and expedited decisions within 72 hours, and publicly report metrics including the percentage of PA requests approved and denied then approved after appeal, as well as the average time between submission and decision. Although our discussion session remarked on the fact that >95% of PA requests are generally approved, the CMS ruling offers a tailwind for innovation and investment as we approach the 2026 deadline.

Areas of Focus

Leveraging the outputs of our 2024 healthcare executive survey and strategic LP roundtable, we have aligned on ten Areas of Focus for 2024. We are thankful for our extensive strategic network that is core to our thesis-driven investment approach and allows us to invest behind themes most relevant to our network. We welcome continued engagement around our sector work, particularly as we continue our quarterly roadmapping efforts on select Areas of Focus.