The Strategic Imperative for Health Plans

Optimizing risk is now a fundamental challenge for health plans amid escalating costs, regulatory shifts, and dynamic member behaviors. Today, advanced payer risk optimization solutions – covering analytics, compliance automation, utilization management, and digital engagement – are essential to safeguard margins, adapt to evolving regulations, and deliver value-based care.

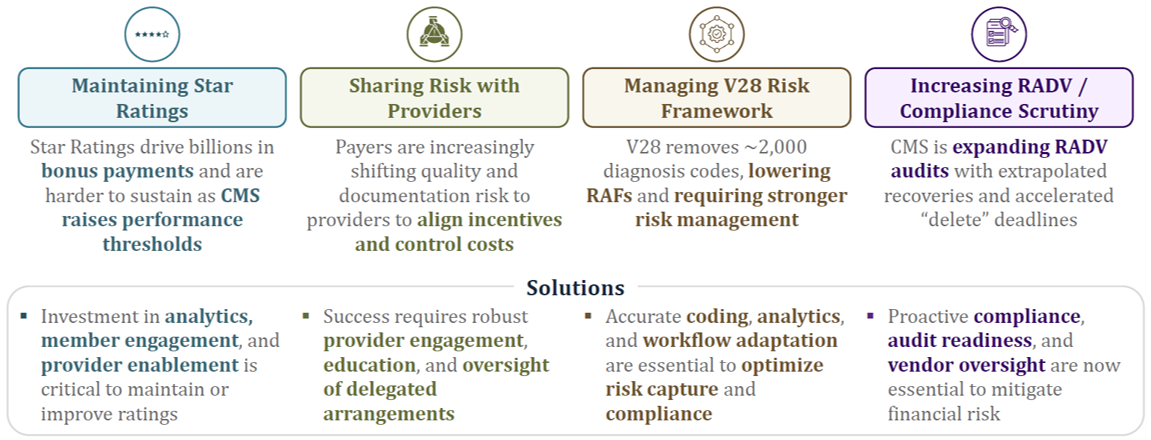

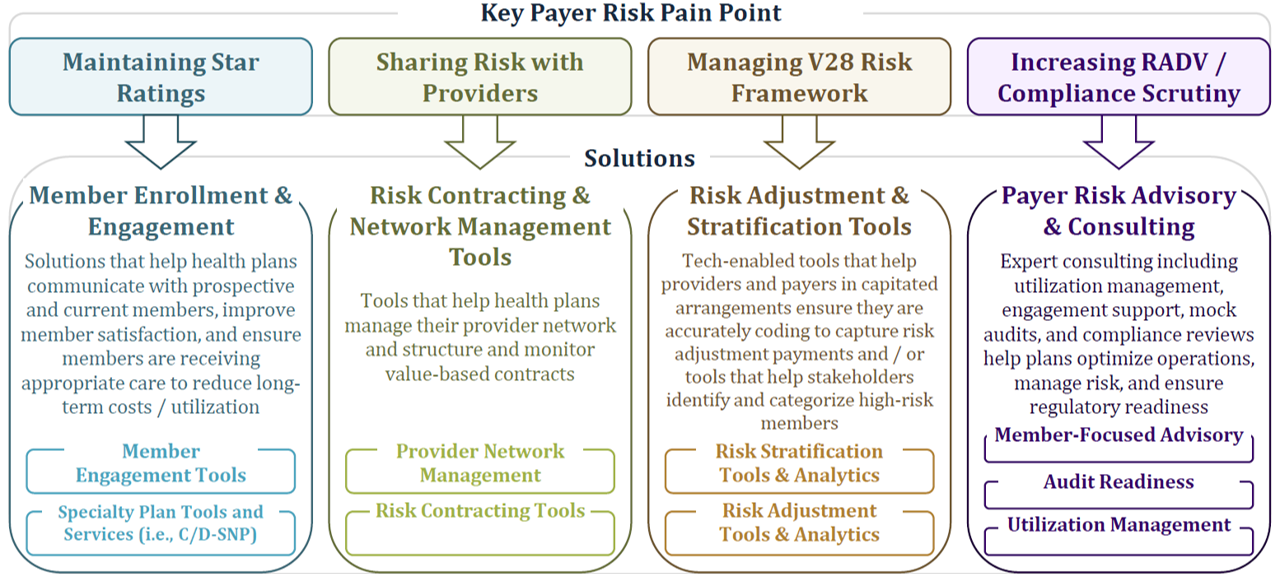

Through our sector analysis, we have identified four core risk strategy investment imperatives that leading payers must address:

1. Maintaining Star Ratings

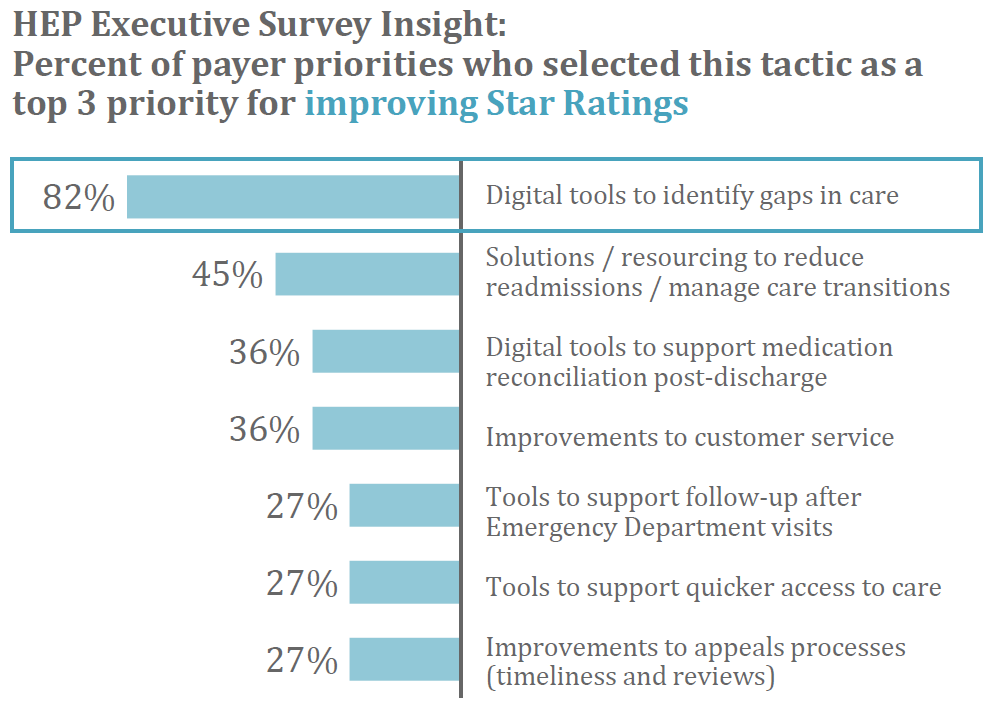

Gaps in care – such as missed preventive screenings, immunizations, or medication nonadherence – significantly reduce plan performance on key Star Ratings metrics (e.g., HEDIS, CAHPS). Addressing these gaps is vital for achieving higher ratings, which drive bonus payments, enrollment growth, and competitive positioning.

- From 2022 to 2025, the percentage of MA members enrolled in plans rated four stars or higher fell from 89.5% to 62.1%, reflecting stricter CMS thresholds and the reversal of temporary, pandemic-era methodologies.

- Achieving 4+ Star Ratings qualifies plans for approximately 5% additional bonus payments per enrollee.

- Over 82% of executives in HEP’s annual survey named digital tools for identifying care gaps as their top strategy to improve Star Ratings.

2. Delegating Risk to Providers

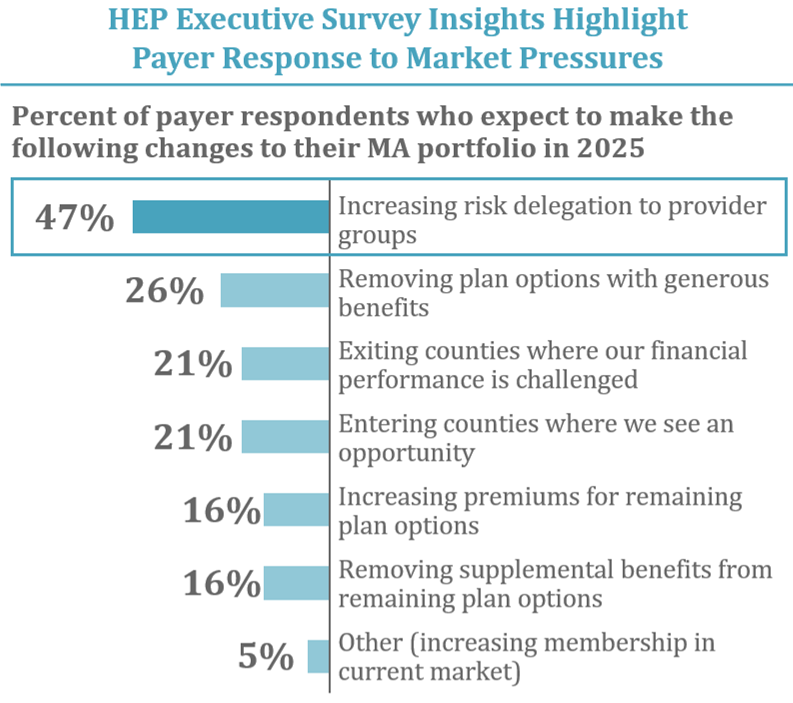

In response to new risks, payers are increasingly moving toward risk delegation – transferring greater financial accountability to providers, who are best positioned to prevent high-cost events.

Key developments include:

- 47% of payer executives plan to increase risk delegation to providers in their 2025 Medicare Advantage strategies.

- Provider network management is a top investment priority, with 23% of healthcare CIOs focusing on data and application platforms to optimize networks, ensure compliance, and retain members.

- Accurate provider directory and credentialing tools are now essential for success in risk-based arrangements. Directory inaccuracies (“ghost networks”) affect care access, cause surprise billing, and erode member trust, with studies showing >80% inaccuracy rates in large directories.

3. Managing the V28 Risk Adjustment Model

CMS’s updated V28 risk adjustment model, phased in from 2024 to 2026, aims to improve payment accuracy and align incentives with clinical realities.

- ICD-10 to HCC Realignment removed over 2,000 diagnosis codes, concentrating on those most predictive of future costs.

- The model now emphasizes clinical severity, raising RAF scores for serious chronic conditions, while “resolved” or less predictive diagnoses are deprioritized.

- Documentation standards are higher: unsupported codes are less likely to impact risk scores, requiring more rigorous and accurate coding.

Implications:

- CMS will audit all ~550 eligible MA plans (up from ~60 previously), requiring enhanced risk adjustment documentation or facing penalties.

- The average risk score for MA plans may drop by 2–3%, directly impacting reimbursements.

- Adaptation demands investment in advanced technology solutions and ongoing staff training to meet the new standards.

4. Impact of Increased RADV and Compliance Scrutiny

Compliance risk is escalating. CMS will now conduct annual audits on all eligible plans, increasing both the volume and intensity of review.

- Audit reach expanded: up to 200 records audited per plan, with the CMS coding team expanding from 40 to 2,000 professionals.

- Strict deadlines: Final submission windows for deleting unsupported diagnoses (2020–2024) mark the narrowest opportunity for correction before audits begin.

- Audit readiness depends on: retrospective audit preparation, robust clinical documentation, accurate coding, and ongoing compliance monitoring.

Additionally, many plans have aggressively deployed AI and analytics without commensurate investment in compliance, creating risk and opportunity: vendors able to deliver integrated, compliance-first solutions are increasingly valuable as partners.

Portfolio Company Spotlight: Alerion Advisors

Alerion Advisors, an HEP IV portfolio company, is uniquely positioned to help payers evolve risk strategies in this challenging environment. As an integrated healthcare consulting platform, Alerion delivers expertise in regulatory compliance, managed care operations, and quality performance, combining:

- Rebellis Group: Strategic consulting expertise,

- Toney Healthcare: Outsourced clinical staffing solutions,

- Advent Advisory: HEDIS audits, data validation, and regulatory compliance services.

HEP’s Viewpoint: Unlocking Competitive Advantage

In today’s rapidly evolving healthcare environment, automating compliance and optimizing risk adjustment are essential for keeping pace with ever-changing regulatory demands. Health plans must embrace advanced analytics, AI, and sophisticated utilization management tools to effectively manage escalating costs – especially those driven by specialty and high-cost therapies. At the same time, enhancing digital engagement and care coordination is crucial for supporting value-based care models and driving superior member outcomes. Ultimately, the ability to deliver audit-ready, compliance-first technology, maximize operational efficiency, and engage members will distinguish industry leaders as regulatory scrutiny intensifies. By investing in integrated, innovative solutions, health plans can achieve sustainable performance, lasting regulatory resilience, and meaningful differentiation in a competitive landscape.

Our Predictions for the Payer Risk Optimization Sector

As the Medicare and commercial payer landscapes grow increasingly complex, plans must navigate stringent risk adjustment requirements, manage escalating costs, and deliver meaningful member experiences – all while maintaining rigorous compliance standards. The path forward demands strategic investment in innovative solutions: from robust risk adjustment frameworks and predictive utilization management to next-generation member engagement tools. Health plans that prioritize integrated, compliance-first technology partnerships will be best positioned to adapt, thrive, and sustain a competitive edge in the face of ongoing regulatory, operational, and market challenges. Now more than ever, embracing innovation and balanced oversight isn’t just an option – it’s a necessity for long-term success.

Want to Learn More?

Each year, HEP caucuses with its advisors and executive partners to evaluate the evolving healthcare and growth equity landscape, with the goal of determining our investment agenda of ten themes for further exploration. Of these Areas of Focus, we select four for our market sector road mapping exercise. This content was excerpted from our Payer Risk Optimization Strategy sector roadmap. To learn more about our sector roadmaps and other thought leadership initiatives, please contact jlaurash@hepfund.com.